is an oversold stock bad

You can buy the stock and sometimes see quick returns as it rebounds. Keep reading to learn about oversold stocks in 2022.

Oversold Check Insider Buying Check Momentum Check

Put simply it trades at a price thats much lower than it should.

:max_bytes(150000):strip_icc()/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

. On its own this doesnt suggest negativity but tells you the uptrend has been strong. When a stock is oversold parties offer the stock beyond the fair value the true value is hard to gauge because everyone calculates differently. While net sales are expected to advance at a double-digit pace up 155 to 293 billion in 2022 net profits are forecasted to tumble 12.

When a stock becomes oversold though its a good thing for new investors. The stock is selling for 3864 and has an average price target of 9545 indicating room for 146 share appreciation in the year ahead. Should you buy when a stock is overbought.

The oversold stock is on a decelerating bottom line path. See APP stock forecast on TipRanks. The stock exhibits an RSI of 244 suggesting it is oversold.

The stocks that arrived at the lower price point are no longer equal to their original value. I think Vales base metals portfolio is still undervalued as there is no sign of a medium-term drop in metal prices. A stock can become undervalued as a result of a major sell-off.

Cramer says stocks are still badly oversold even after Wall Streets big rally. LUV stock has an RSI score of just over 30 which is putting it right about in oversold territory. Suppose a stock value suddenly falls because of issues in the company bad reports or any mass withdrawals of traders believing that the stock may be overpriced.

An oversold condition in shares is typically considered to occur when there are more sell orders for a companys stock than buy orders. While net sales are expected to advance at a double-digit pace up 155 to 293 billion in 2022 net profits are forecasted to tumble 12. The share price would go on to rise from under 36 up to a.

As a result it causes the price of the share to drop. Usually an RSI below 30 indicates an oversold stock. More recently the SP 500 index has been down about 13 since the beginning of the year.

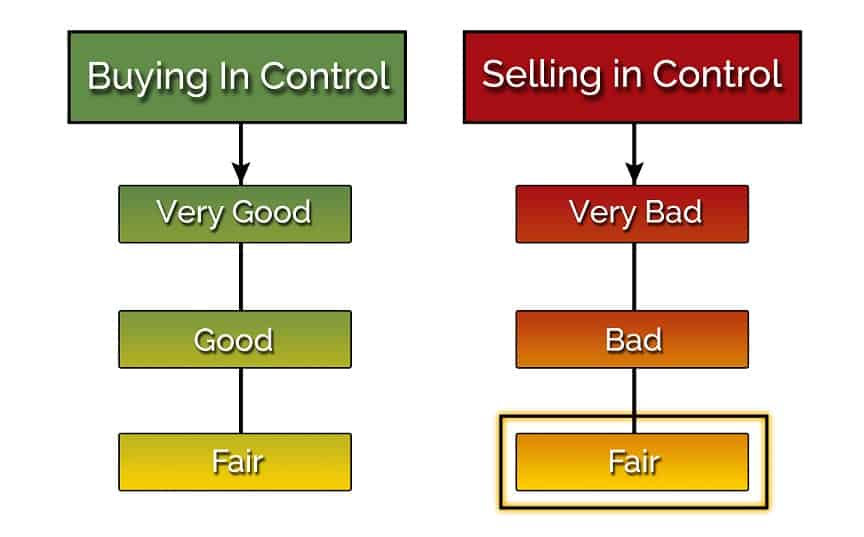

Generally an oversold stock suffers from overreacting traders. Being overbought doesnt necessarily hurt a stock because it could signal buyer interest as well as a profit point for the securitys investors. One of the worst rookie mistakes of technical analysts is to think of overbought as bad and oversold as good.

However this does not mean that investment into that particular stock is inherently bad. When a stock is overbought with an RSI above 70 all that means is that the price has gone up a lot thats it. Traders and investors need to identify the reasons of such price decline in order to make an informed.

The oversold stock is on a decelerating bottom line path. Another scenario is when large buyers take out stop orders before the subsequent repurchase at a better price. This as the name implies reflects a stock that appears to be worth more than the price it is trading at.

This is good for some bad for others or even neutral. The stockprice to dip below the fair value. CNBCs Jim Cramer said Thursday that trying to get into.

This means that its. Was even more oversold at the time as the stock was at an RSI level of just 26. General Electric went from 33 a share 2 years ago to 7 late last year.

The opposite of an overbought stock is an oversold stock. When a stock is oversold it trades at a price below its intrinsic value. One of the worst rookie mistakes of technical analysts is to think of overbought as bad and oversold as good.

When a stock is oversold the implication is that selling has pushed the price too far down and a reaction called a price bounce is expected. Part of the reason for investor pessimism is that Warren Buffetts hedge fund Berkshire Hathaway NYSEBRKA NYSEBRKB sold their entire stake in. As opposed to overbought oversold means that stock prices have decreased substantially.

Like an overbought stock is not necessarily bad the existence of an oversold condition does not mean that the stock is a good stock. On its own this doesnt suggest negativity but tells you the uptrend has been strong. More Bad News for the Stock Market.

This means that we as mean reversion traders are trying to catch falling knives and should expect prices to continue down a bit before they reverse. As the market is always right there are factors not known to everyone causing. Oversold means the stock price has taken a nosedive and theoretically selling pressures have exhausted and people may be willing to start buying it again driving the price back up.

Stocks are facing a few more issues than just rising interest rates. This observation isnt flawed but showcases one of the disadvantages of mean reversion strategies which is that a market that is oversold always can become more oversold. When a stock is overbought with an RSI above 70 all that means is that the price has gone up a lot - thats it.

As the stock market digested the potential for rising interest rates it began to decline.

:max_bytes(150000):strip_icc()/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

Oversold Stocks Most Oversold Stocks Today

Oversold Stocks Intraday Marketvolume Com

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

How To Know If A Stock Is Overbought Or Oversold Quora

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

Forget Warning Signs Stocks Are Now Extremely Overbought Seeking Alpha

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

5 Oversold Stocks Ready To Rebound Thestreet

5 Oversold Stocks Ready To Rebound Thestreet

How To Know If A Stock Is Overbought Or Oversold Quora

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

Forget Warning Signs Stocks Are Now Extremely Overbought Seeking Alpha

Determining Overbought And Oversold Conditions Using Indicators

Oversold Stocks Short Term Marketvolume Com

Market Oversold The Best Way To Tell If The Market Is Oversold

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)