japan corporate tax rate pwc

The fiscal year 2022 tax reform outline was released on 10 December 2021. On 26 March 2021 as a part of Japans 2021 Tax Reform.

Preparing Mncs For A Global Tax Rate

Corporate resident tax Hojin Juminzei.

. 1 million yen 15 150000 yen. This rate was 22 for fiscal years 20182019 and 2020 temporarily. Message from CEO Our group Our Services Corporate Responsibility Code of.

150000 yen 173 70000 yen 95950 yen. 96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. However the WHT rate cannot exceed 2042 including the income surtax of.

New Rules Allow Japanese Tax Authorities to Unilaterally Appoint Local Tax Administrator of Foreign Taxpayer. The revised definition of PE. Before this amendment the corporate income tax rate was 20 for the year 2021.

The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer. Asia Pacific Tax Insights app. The PwC Japan group includes PwC Aarata PricewaterhouseCoopers Kyoto PricewaterhouseCoopers Co Ltd PwC Tax Japan PwC Legal Japan and their subsidiaries.

With the Law no. The CNIT rate for the 2022 tax year is 999. Corporate Tax Rate in Japan averaged 4049 percent from 1993 until 2022 reaching an all time high of 5240 percent in 1994 and a.

Our knowledgeable teams help many companies to conform to the latest. Jersey Channel Islands. Business tax Jigyo zei.

1342 reduces the tax rate to 899 for the 2023 tax year. The special local corporate tax rate is 4142 and is. PwC Tax Japan is the firm that.

Information on corporateindividual tax ratesrules in 150 countries. Asia Pacific tax and business insights all in one hand. In this alert we provide an overview of the major reforms and revised provisions contained in the.

The Corporate Tax Rate in Japan stands at 3062 percent. Corporation tax Hojin zei. Starting with the 2024 tax year the rate is reduced by 05 annually until it reaches.

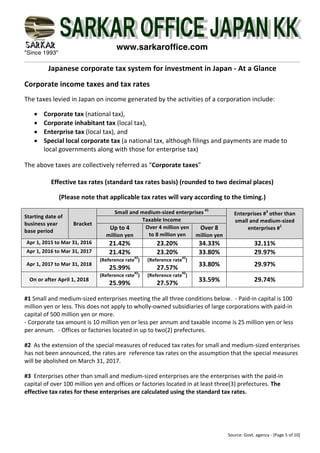

Information on corporate and individual tax rates and rules in over 150 countries worldwide. The articles of the Corporate Tax Law CTL and CTL Enforcement Ordinance CTLEO were revised to agree with the updated Article 5 of the OECD MTC. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34.

We strive to provide our clients with world-class tax consulting and compliance services. The business environment for Japanese companies has changed drastically driven in part by globalization BEPS the introduction of the Corporate Governance Code requiring the. 151 rows Japan Last reviewed 08 August 2022 232.

You understand how much of a challenge it can be trying to keep on top of the tax rates and. Notice of the PwC Tax Japans Actions in relation to State of Emergency as of May 26 2020 Click here.

Tax Reporting Strategy Tax Services Pwc

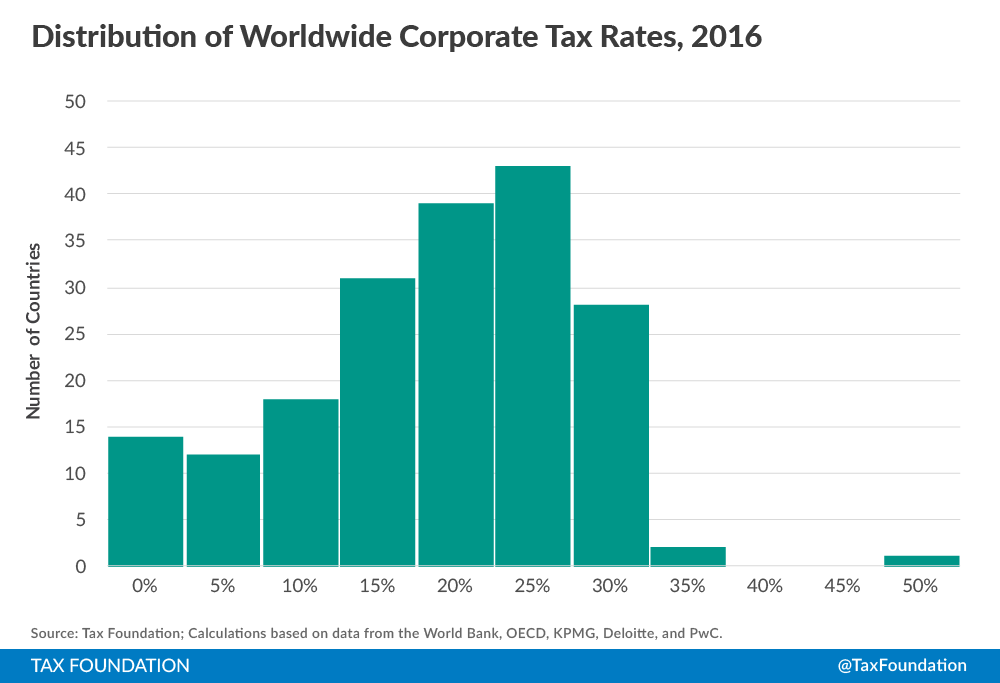

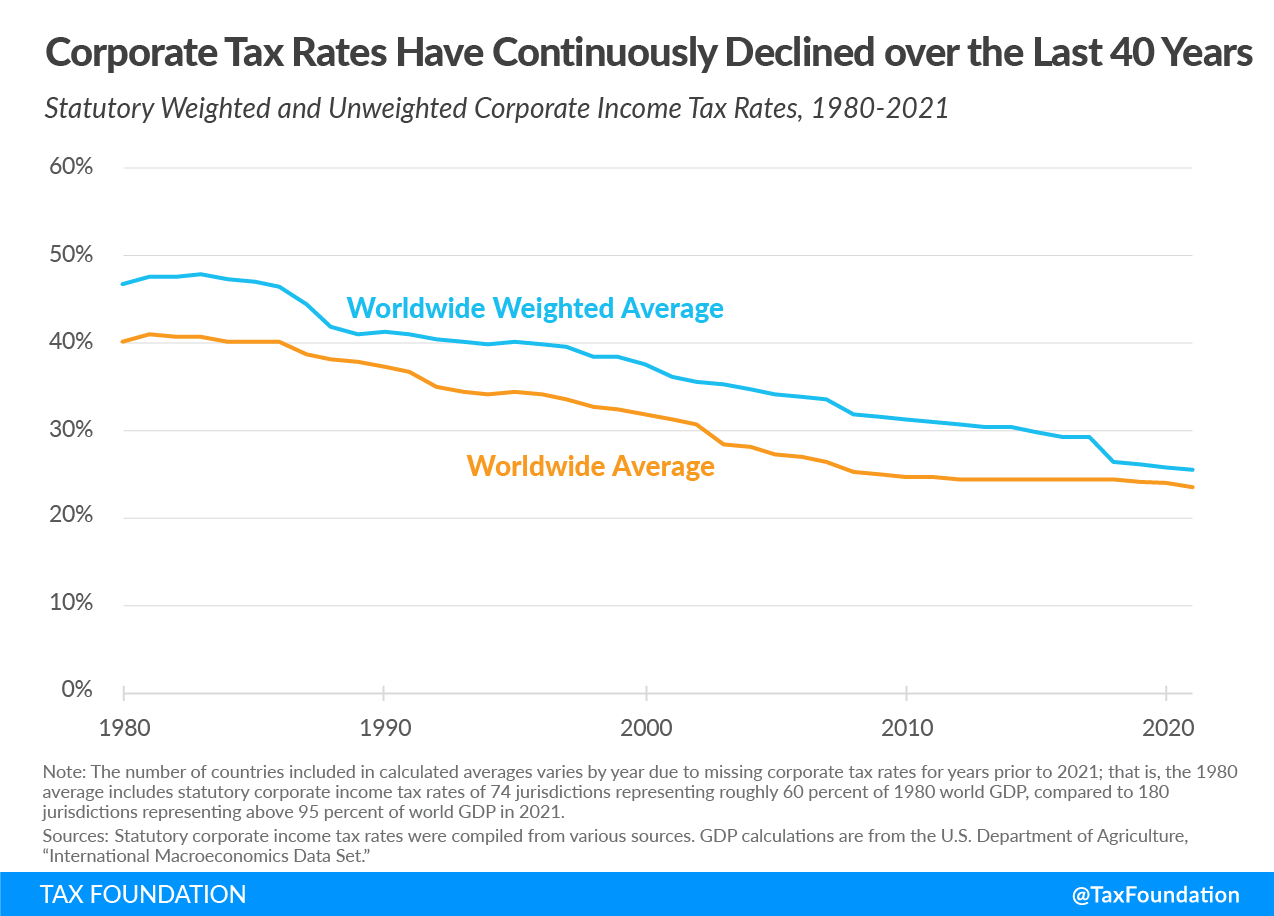

Corporate Tax Rates Around The World Tax Foundation

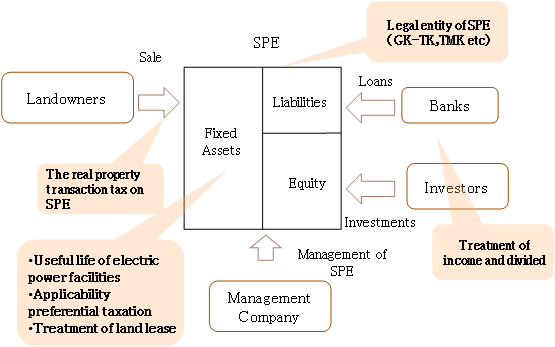

Tax Issues On Operation And Investments In Renewable Energy Business Pwc Japan Pwc Japan Group

Working At Pwc Jobs And Careers At Pwc

Corporate Tax Rates Around The World Tax Foundation

Paying Taxes 2020 In Depth Analysis On Tax Systems In 190 Economies Pwc

Japan Corporate Tax Rate 2022 Take Profit Org

Accounting Firms Kpmg And Pwc To Exit Russia Reuters

Worldwide Tax Summaries Tax Services Pwc

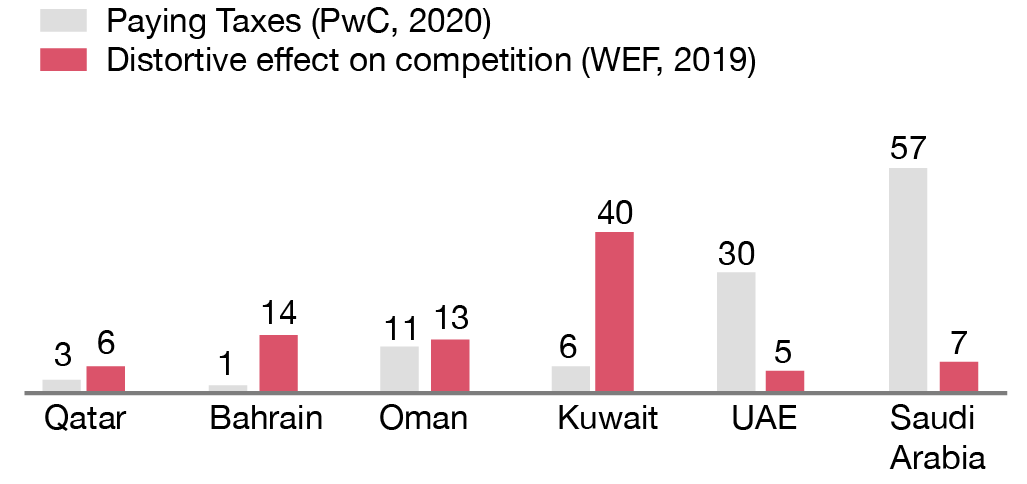

From No Tax To Low Tax As The Gcc Relies More On Tax Getting It Right Is Critical For Diversification Pwc Middle East Economy Watch

Japanese Corporate Tax At A Glance In Bullet Points

Executive Views On Business In 2022 Pwc

Corporate Tax Rates Around The World Tax Foundation

Hong Kong Has World S Most Business Friendly Tax System Say World Bank Pwc Wsj

Changes In Corporate Effective Tax Rates During Three Decades In Japan Sciencedirect

Worldwide Tax Summaries Tax Services Pwc

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation